Motor Vehicle Tax stamps

In MFN newsletter number 69 (2004) there was a brief mention about the USA Motor Vehicle Tax stamps (unfortunately only in Dutch). These were to provide additional income to finance the war. The stamps could be purchased at post offices and had to be visibly attached to the vehicle.

I still asked myself whether these stamps actually belong to our collection area. Are these stamps postage stamps, because they were sold at post office counters? Should they also be purchased by owners of motorized two-wheelers? Are there used Motor Vehicle Tax stamps for motorcycles?

Those are quite a few questions.

What and for which purpose are Motor Vehicle Tax stamps?

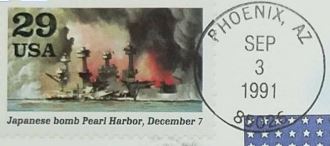

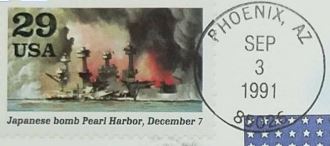

In mid-1941, the United States of America became increasingly involved in the war. On 3 December the attack on Pearl Harbor followed and USA declared war on Japan.

This required extra money. After deliberation it was decided to levy additional taxes, a total of 3.5 billion dollars. 1/3 had to be raised through an increase in income tax, 1/3 through an additional corporate tax levy and the last 1/3 through an additional excise duty on raw materials. An increase in fuel excise duties was also on the agenda. When major protests broke out, the government had already replaced the fuel tax by a Motor Vehicle Tax, which was set at USD 5 per fiscal year.

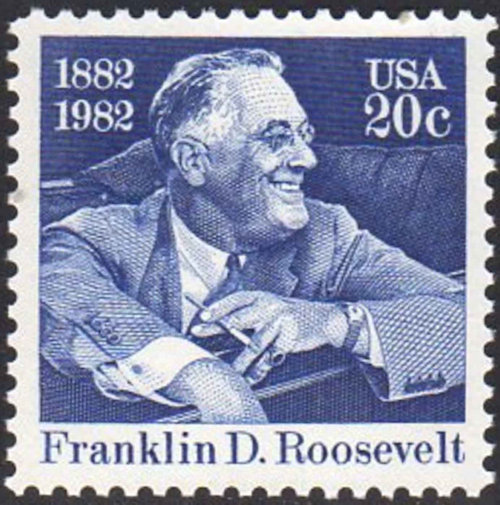

The law was passed on 4 August and went into effect on 20 September 1941, after being signed by President Roosevelt.

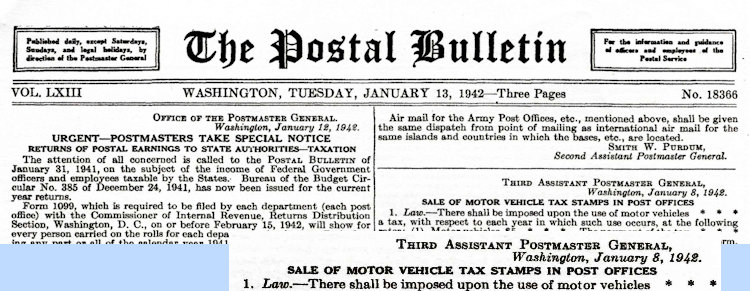

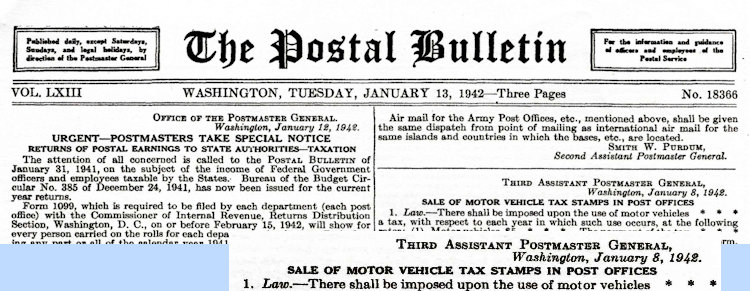

Every day the US Postal Bureau issued a circular with information for all postal workers. On Tuesday 13 January 1942 an article appeared in it with the rules and guidelines regarding the Motor Vehicle Tax stamps.

Although it was a measure by the Tax Authorities (IRS), the administrative handling was left to US Postal.

The article in The Postal Bulletin explained the treatment of the MVT stamps in 18 points. Not all points are interesting to us. I will point out the most important ones.

Sale of Motor Vehicle Tax zegels in the post offices

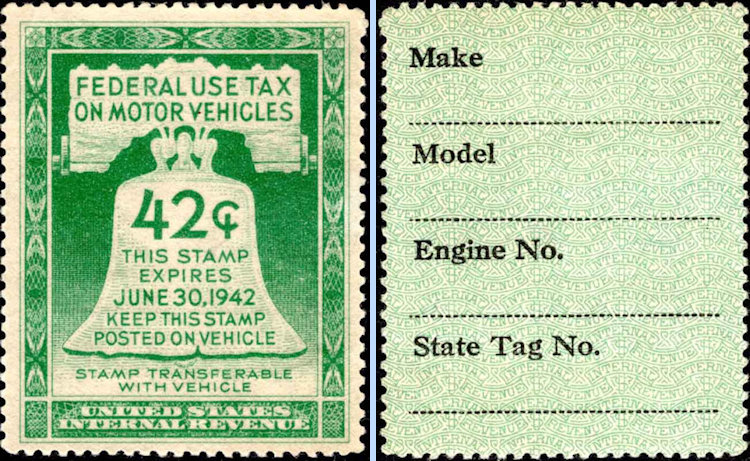

Point 1: A tax of USD 5 per vehicle per year will be imposed upon the use of motor vehicles until further notice. Proof of payment is a stamp, sticker or tag, which must be affixed to the vehicle in a manner prescribed by the Minister. Naturally, government vehicles are exempt from the tax.

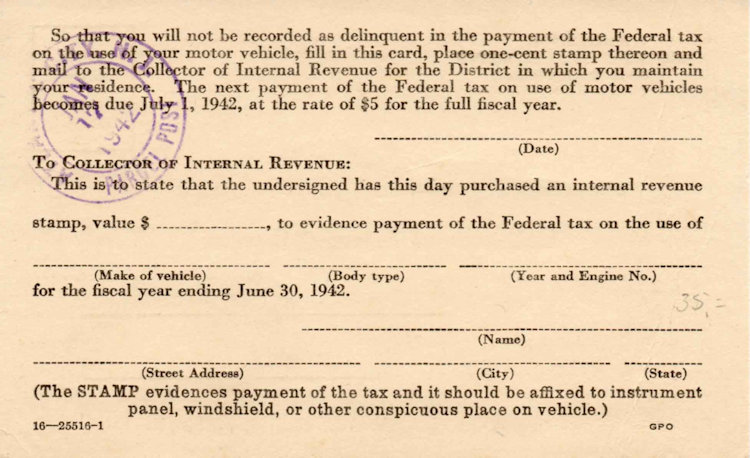

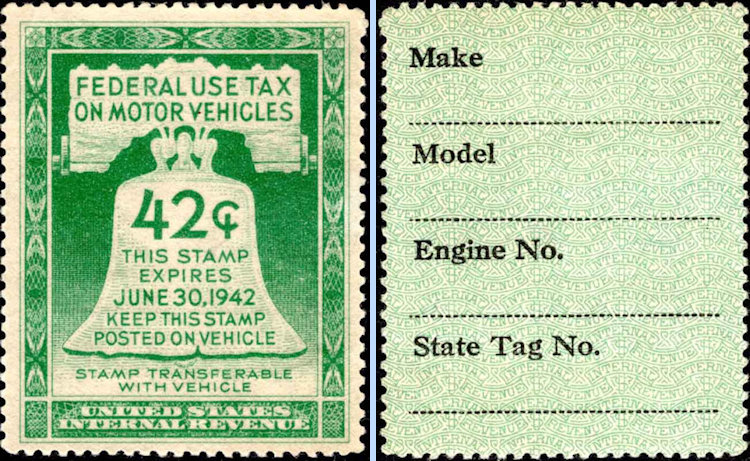

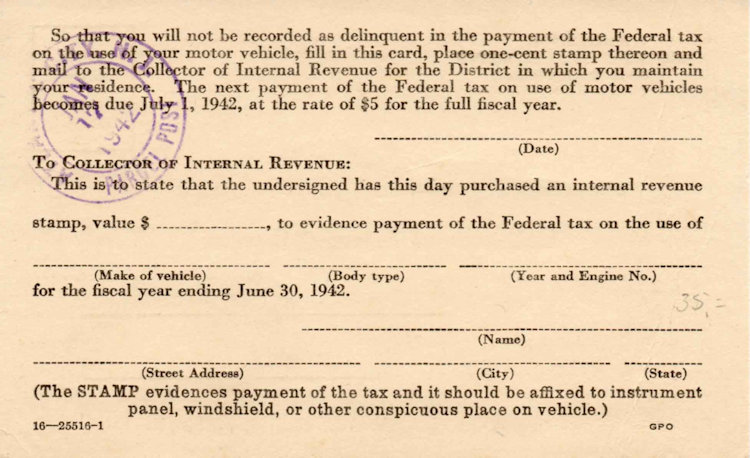

Point 2: Because it has been decided to collect the tax per fiscal year (in the USA starting on 1 July and ending on 30 June), the stamps are sold every month from July to June of the following year. Starting with the value 5.00 USD for stamps purchased in the month of July, 4.59 USD in September, 4.17 USD in October and so on up to 0.42 USD in June. It is ensured that every month a supply of MVT stamps for the following month is sent to post offices. Since the law takes effect on 1 February 1942, the MVT stamps, worth 2.09 USD, are delivered as quickly as possible and offered directly to the public. The back of the stamp must be filled in by the owner of the vehicle.

Point 3: The stamps, issued by the Postal Department, will be forwarded through all central-accounting post offices to local post offices. Postal officials keep track of the arrival and sales of the stamps and submit the sales of the month to the Collector of Domestic Taxes no later than the 15th of the following month.

Point 7: When purchasing an MVT stamp, the buyer also receives an MV-1 card. This card must be completed and mailed with a 1 ct stamp to the local IRS office. The number of cards submitted should correspond to the number of stamps sold.

Point 10: Redemption, repurchasing or exchange of MVT stamps by postal officials is not permitted. Persons wishing to do this should be referred to the local IRS office.

Point 18: Notice to the public that the tax applies to all motor vehicles, including passenger cars, trucks and motorcycles used on highways.

Punt 19: Postmasters must create a prominent notice and post it near the postal counter where Motor Vehicle Tax stamps are sold, informing customers of the correct address of the Internal Revenue Collector of the local county where report cards (MV-1) must be sent by buyers of these MVT stamps.

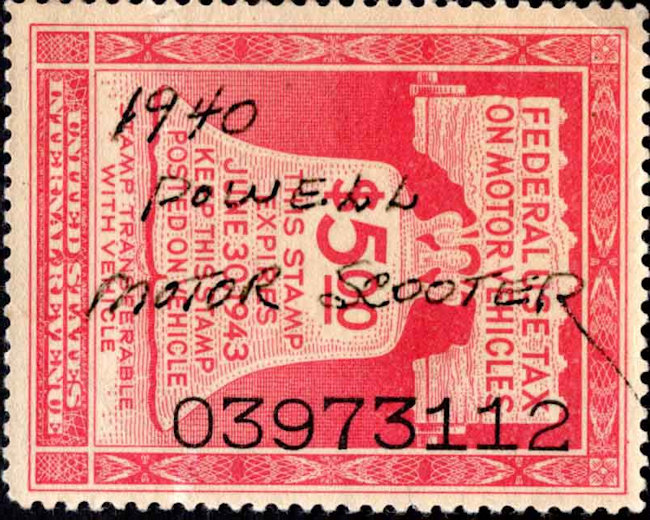

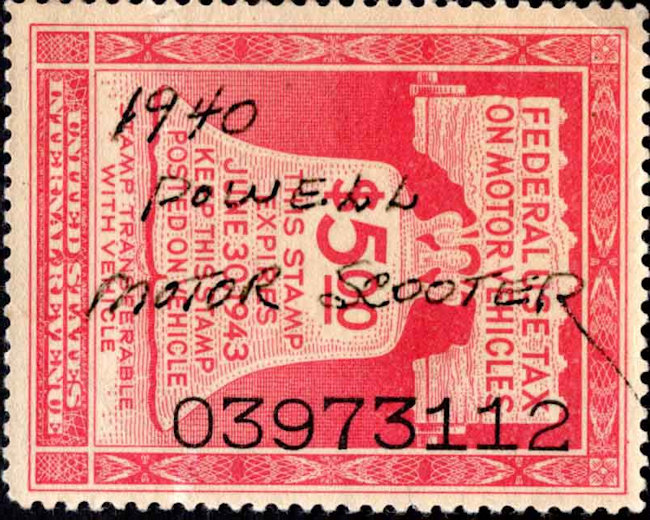

On the left a stamp from the first series (42-45) with the image of the Liberty Bell. On the right a stamp from the second series (45-46) with image of Daniel Manning, Secretary of the Treasury from 1885 to 1887.

Soon (minor) adjustments were made to the above law. In February 1942, a notice was sent to all post offices that lost Motor Vehicle Tax stamps should be reported to the office of the local Internal Revenue Collector.

In May 1942 it was announced that sending the MV-1 cards was no longer necessary.

It was also reported in May that all MVT stamps will receive a serial number.

The last announcement in April 1946 announced that the Motor Vehicle Tax would cease at the end of the fiscal year. So at the end of June 1946.

Thus the Motor Vehicle Tax Zegels are NOT postage stamps. They are fiscal stamps, that have been supplied to the public through the Postal Service.

Where they also intended for motorcycles?

Since point 18 explicitly states that motorcycles are also covered by the law, the Motor Vehicle Tax stamps certainly belong to our collection area. Just like other tax stamps that were used to show that fees, tolls or any other tax have been paid. According to point 18, Motor Vehicle Tax stamps were ALSO intended for motorcycles.

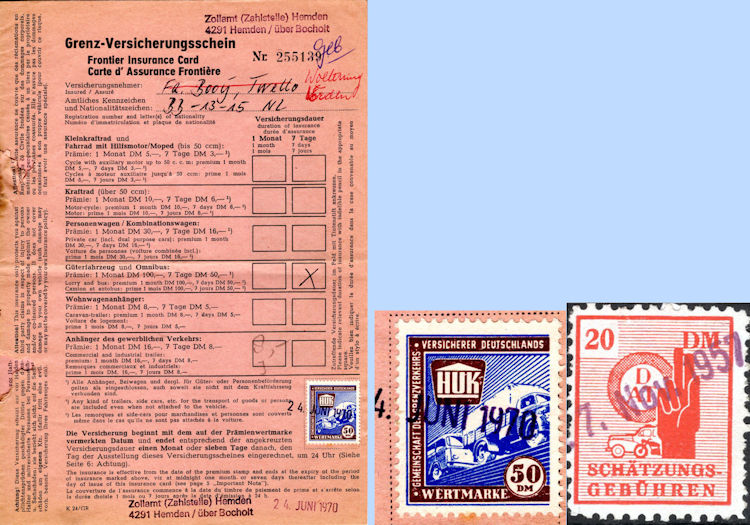

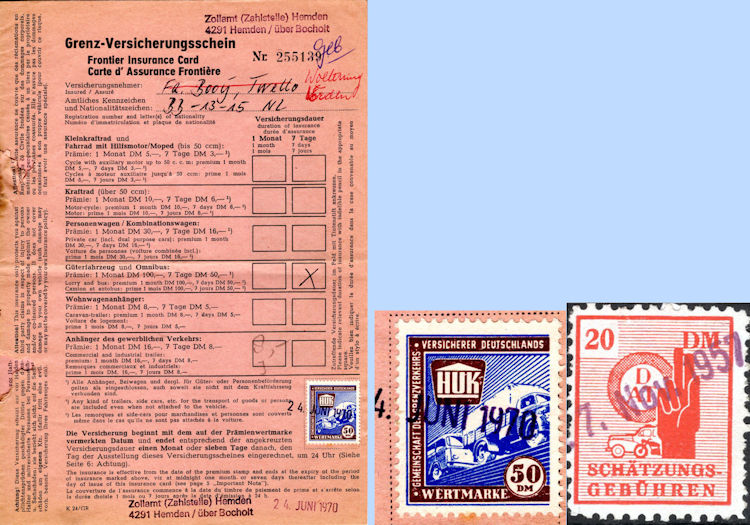

Border Insurance Form, for insurance from border to home for an imported car or motorcycle

There were some problems with the MVT stamps. As mentioned above, the stamps had to be visibly attached to or on the vehicle. The first MVT stamps had an adhesive layer on the back that allowed them to be stuck on the outside of the windshield. Due to weather influences and other external forces, the stamps often became damaged and unreadable. The next series of stamps were therefore supplied with a layer of glue on the front, so that they could be stuck to the inside of the window.

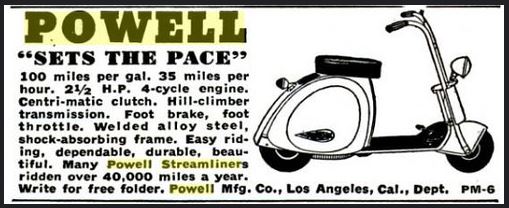

But for motorcycles without a windshield there was also a problem. Where should the stamps be attached? Some riders found a solution in a holder for the stamps mounted on the handlebars.

Are there used Motor Vehicle Tax stamps that have been used for motorcycles?

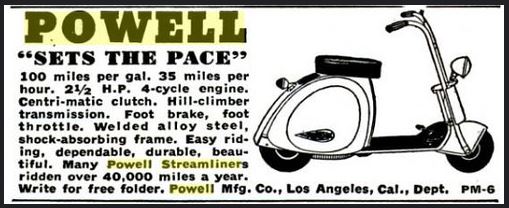

Finding used MVT stamps is difficult, because they are often damaged when removed, and finding MVT stamps used for motorcycles is even more difficult. Why are used stamps necessary? Well, on the back the owner had to fill in the make and type of the vehicle, and this shows that the stamp has been used for a motorcycle. Finally, in my long search, I found one. Not from a motorcycle, but still from a two-wheeler, a motor scooter.

It is clear to a collector that the Motor Vehicle Tax stamps certainly fit into a motorcycle collection. For most of us, that is enough to add any found (un)used stamps to the collection.

Some members, including the writer of this article, still have an additional question: can such stamps be used in a thematic exhibition collection?

Everything that is made, issued and used by the Postal Service for postal purposes may be displayed. But the Motor Vehicle Tax stamps are not issued by the Postal Service. On this basis they would not be allowed.

The exhibition guidelines, especially paragraph 3.1 "Suitable philatelic material", say:

Suitable postal-philatelic material has the following characteristics:

Nature of the material:

Tax stamps: they are accepted as long as they are used postally or have postal validity. Tax stamps for tax purposes are allowed in exceptional cases, if they are the only means of describing an important thematic element.

The Motor Vehicle Tax stamps are not used postally but may be used if there is NO other material to describe a specific thematic detail. But they must be supported by sound philatelic justification.

Borderline cases ("borderline material"):

Items belonging to a specific philatelic culture of a theme, a country or an area can be tolerated,

as long as these items are justified and their number is proportionate to the extent to which the exhibit has been developed.

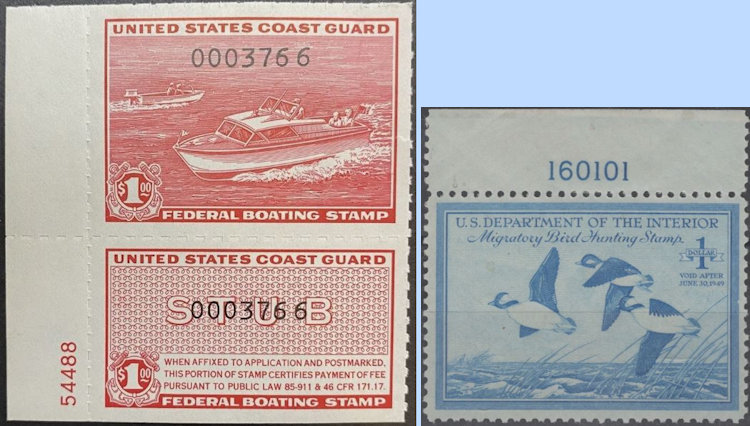

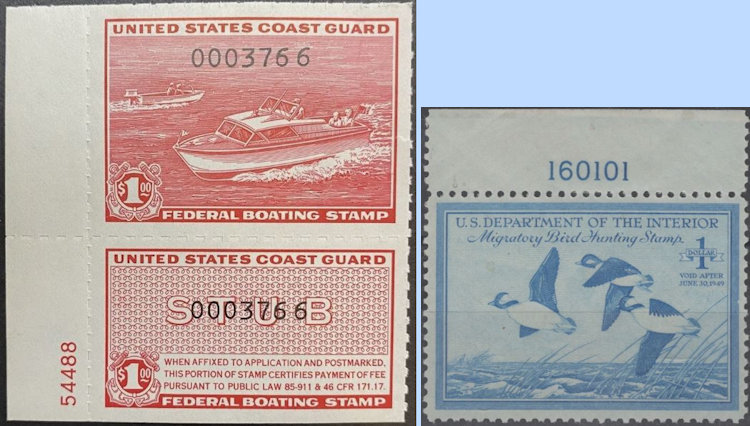

In the USA also other kinds of taxes are arranged via the Postal Service. Think of Boating stamps en Hunting Permit stamps.

Paying taxes in this way, using stamps purchased through the post office, is thus part of American culture.

Conclusion: to my opinion Motor Vehicle TAX stamps may be incorporated if supported with a well-substantiated philatelic explanation, but will then be tolerated without contributing to the valuation of the collection.

Nico Helling

Sources:

http://www.uspostalbulletins.com/pdfsearch.aspx?pid=1&Group=48&id=48

https://enotrans.org/article/the-federal-tax-on-driving-an-automobile-1942-1946

https://www.knbf.nl/bestanden/102-04-05b-richtlijnen-thematisch-knbf-1.pdf?cd=i

Top - Back to former page - Home |